EUR/USD Rate May Rise to 1.0774 by March 31, 2025

Published on: January 12, 2025

According to our forecasting model, the euro to US dollar (EUR/USD) exchange rate has a high probability of rising to 1.0774 by March 31, 2025, which represents a +5% increase compared to the rate on January 12, 2025 (1.0244). This forecast is based on fundamental analysis, which considers key economic indicators from the US and the Eurozone.

Economic Data as of March 31, 2025:

- Federal Reserve Rate (FEDRATE): 4.44%

- European Central Bank Rate (ECBRATE): 2.65%

- US Consumer Price Index (USCPI): 2.0%

- Eurozone Consumer Price Index (EUCPI): 2.2%

- US GDP Growth (USGDP, quarter): 1.8%

- Eurozone GDP Growth (EUGDP, quarter): 1.6%

- US Unemployment Rate (USUNEMPL): 4.4%

- Eurozone Unemployment Rate (EUUNEMPL): 6.6%

Factors Influencing the Forecast

Monetary Policy of Central Banks:

The difference between the Fed's and ECB's rates remains significant (1.79%), which enhances the attractiveness of the US dollar for investors. However, a stabilization of rates is expected in 2025, which will reduce capital outflows from the Eurozone and support the euro.

Inflation:

The inflation rate in the Eurozone (2.2%) is slightly higher than in the US (2.0%). This could lead to more aggressive actions by the ECB to further tighten monetary policy.

Economic Growth:

While the US economy shows higher GDP growth (1.8% versus 1.6% in the Eurozone), the gap is small, indicating that both economies are relatively stable.

Labor Market:

The unemployment rate in the US is lower (4.4%) compared to the Eurozone (6.6%). However, the Eurozone shows signs of improving employment, which could provide long-term support for the euro.

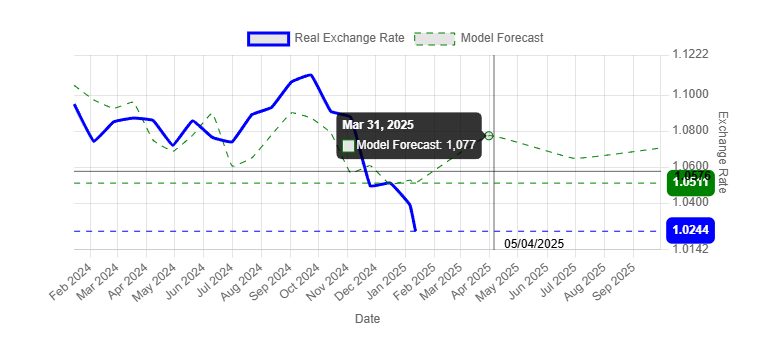

Model Chart

As shown in the chart, the model repeats the exchange rate with a maximum deviation of 3.7%. Currently, the deviation is 2.6%, the current rate is 1.0244, and the model's forecast is 1.0511, which indicates a high probability of real rate growth.

Potential Risks to the Forecast

- Geopolitical instability could lead to sharp market movements.

- Unexpected economic events, such as crises or sudden changes in central bank rates.

- Discrepancies between market expectations and actual actions by regulators.

The projected EUR/USD growth to 1.0774 is driven by the stabilization of macroeconomic factors and moderate improvement in Eurozone indicators. However, it's important to remember that forecasts may change depending on economic factors and unexpected events such as crises, geopolitical instability, or sudden changes in monetary policy by central banks.

This forecast may be useful for traders, analysts, and investors interested in the currency market. For more information and the latest forecasts, visit here.